Refund Involuntary Deductions

How to refund involuntary deduction in Oracle cloud Payroll?

You can perform this after logging into Oracle Payroll, in two steps:

1) Refund Employee

2) Adjust Involuntary Balance

In this example –

Employee was paid on 4/28 and involuntary deduction was taken out for pay period 4/9 to 4/22 with check date 4/28. In the example screenshots below, we want to refund the employee in the next pay period. Hence, element entry will be created starting next pay period (4/23 – 5/6) and amount will be refunded on check date 5/12. If an immediate refund is needed to pay out earlier, refund entry can be created in pay period starting 4/9-4/22 and quick pay may be processed immediately.

Step 1 – Refund Employee

Balance adjustments must be made on the original pay date when involuntary deduction was deducted.

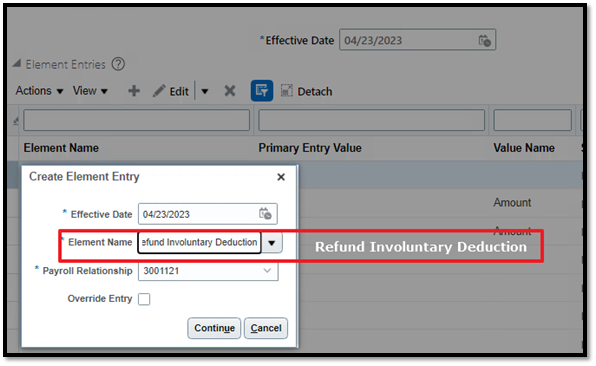

- Change Effective Date to the Pay Period Start date you are refunding.

- Create an element entry for the amount you are refunding.

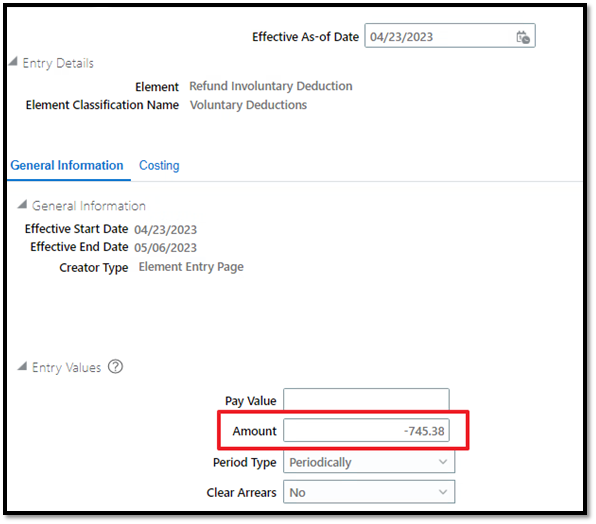

3. Enter negative amount for refund involuntary deduction element

- Add Fee amount as well in case fee was charged to the employee. e.g. if $2 is charged for fee, enter -747.38 as the Amount.

- Process Regular Pay in the next pay period or process quick pay to pay employee immediately.

Step 2 – Adjust Involuntary Balance

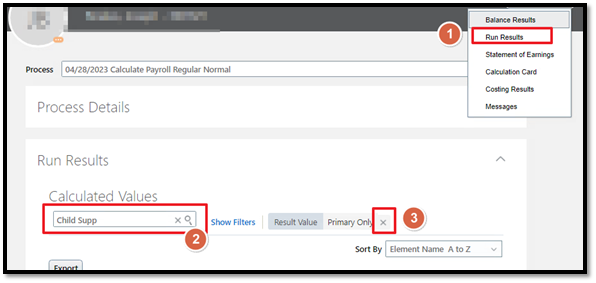

- Get Values of Third-Party Payee from Run Results

- Go to SOE => Run Results

- Search for your element => Remove “Primary Only” filter

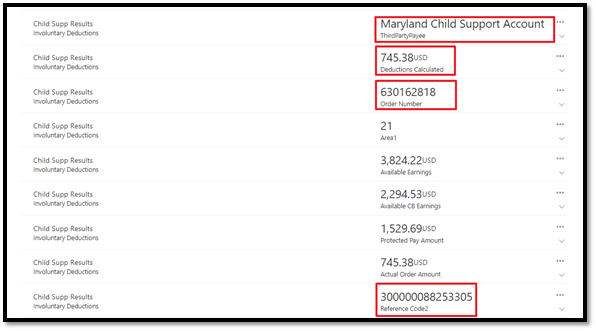

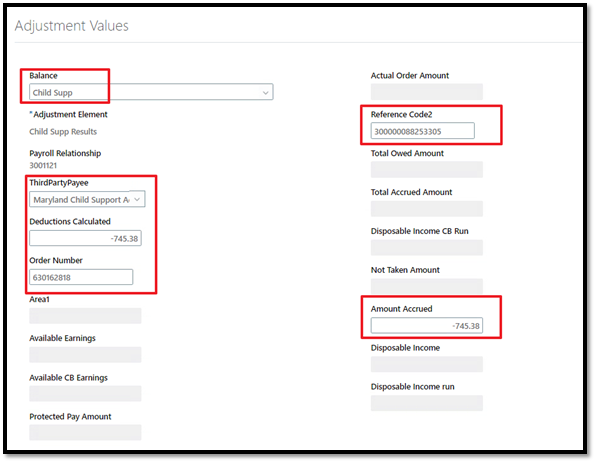

We want to get Third Party Payee, Deductions Calculation, Order Number and Reference Code2 values from the run results.

- Go to Adjust Individual Balance Screen and Change Effective Date to the check date when the involuntary deduction was deducted.

- Enter Balance Name and Input values will appear for adjustment. Enter the information as below

- Save.

- After saving the adjustment, scroll down to the Costing and Payment Details Section. Make sure Costing and Payment is UNCHECKED.

Step 3 – Directly Pay Employee by Check.